A Reference Shareholder is a shareholder who, without necessarily holding a majority share in a company, has a sufficiently large stake to influence its decisions.

For Renault Group, the French State is the Reference Shareholder. Nissan was not a major shareholder, because even if Nissan held the same number of shares as the French State, they were deprived of voting rights until 2023.

Each year, a report is published under the aegis of Martin Vial, commissioner of State holdings (and director of the group), which takes stock of the companies in which the French State is a Reference Shareholder.

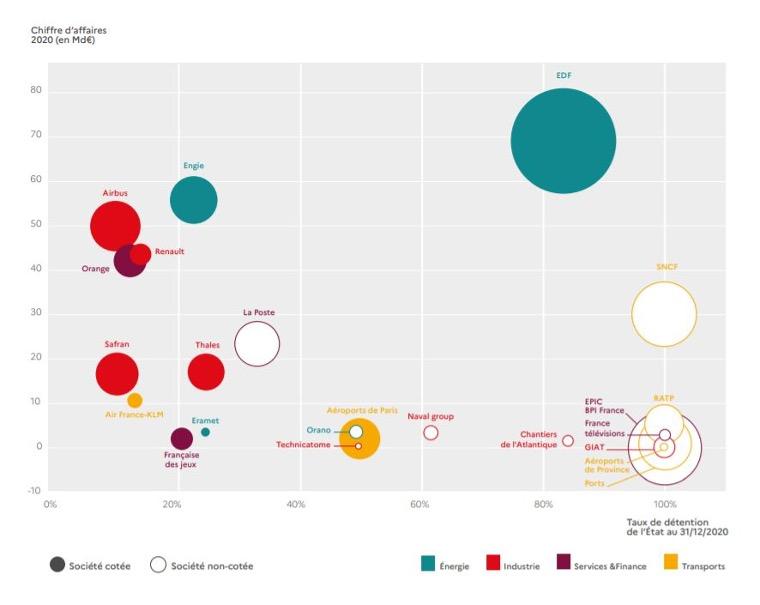

In this graph, which is extracted, the diameter of the circles is proportional to the valuation of the shares held by the State. We can see, compared to other listed companies with comparable turnover, with similar State participation (Orange, Airbus, Engie), how Renault Group is undervalued compared to these companies.