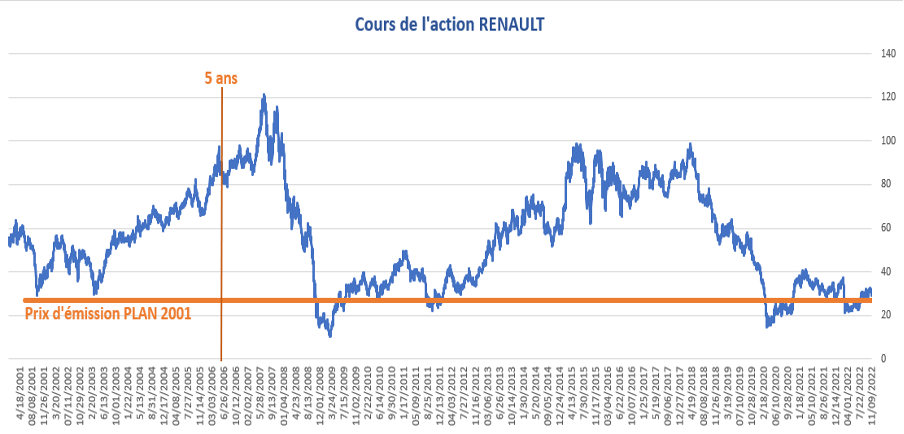

The first Employee Share Ownership plan at Renault took place in 2001, as part of a capital increase. The price paid by employees was €27 per share. At the end of the 5 years of blocking, the share price was above €80, which already offered significant added value.

But by waiting two more years, the price would rise above €110. For those who missed this opportunity, another period of prices above €80 was reached between 2015 and 2018.

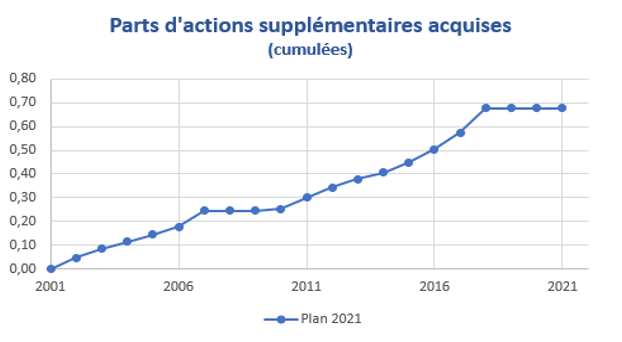

But the capital gain on the resale of shares is not the only profit achievable. Employee Shareholders do not receive a dividend, but the equivalent thereof is immediately converted into additional shares, which increase accordingly.

This graph opposite shows that for one share acquired in 2001 and held to this day, the employee would now have 1.7 shares thanks to dividends. Which, on the one hand, increases the profit in the event of a transfer, and on the other hand gives more weight to the employee's vote at the General Meeting.

The following year, a second Employee Share Ownership plan was implemented, this time due to a transfer of shares by the State, which legally required reserving 10% for employees. The price paid by employees was €41.44. If the possible capital gain was therefore reduced compared to the 2001 Plan, the favorable periods for resale remained the same and the additional shares obtained due to unreceived dividends remained very close to those of the 2001 Plan.